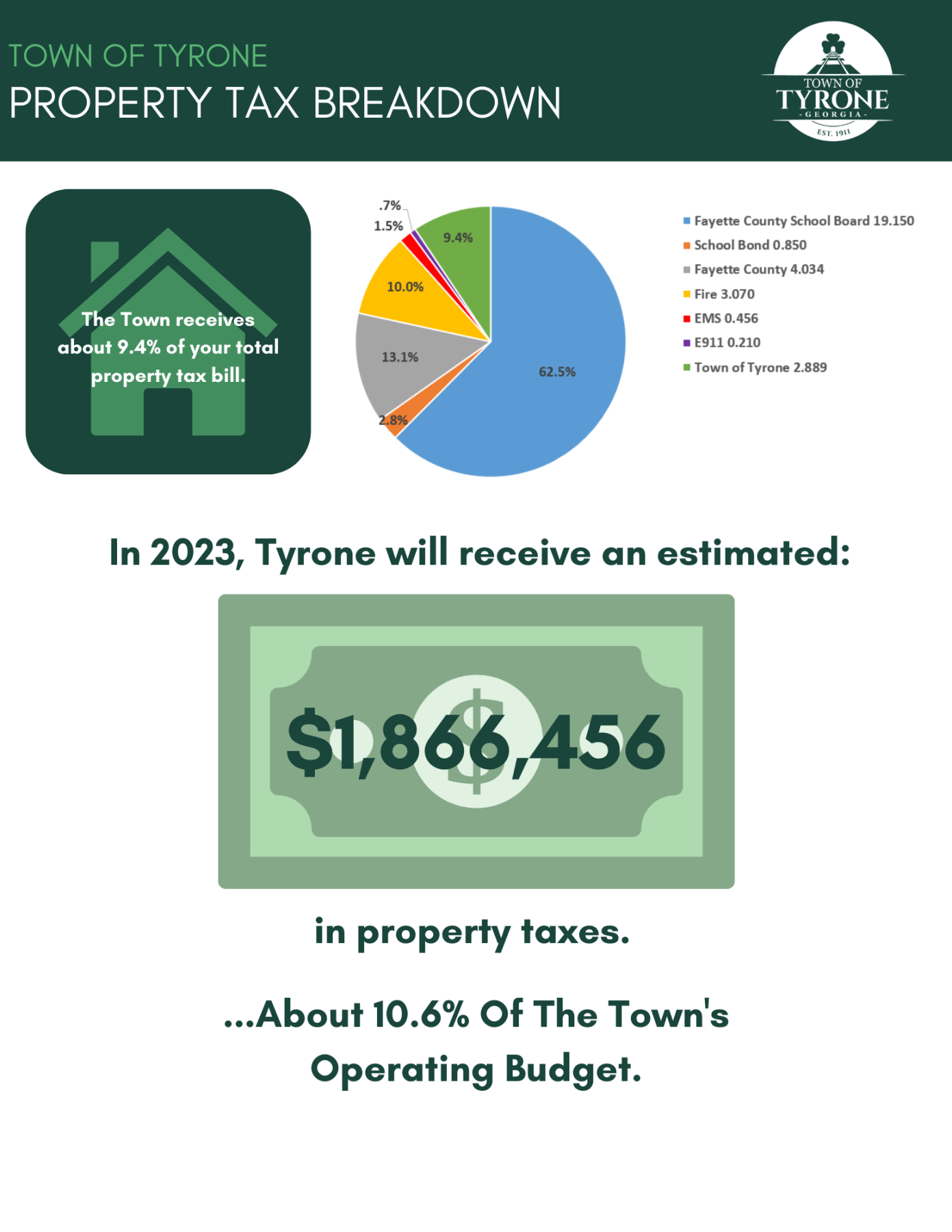

The revenue generated by property tax collections funds approximately 10% of the Town's annual operating budget.

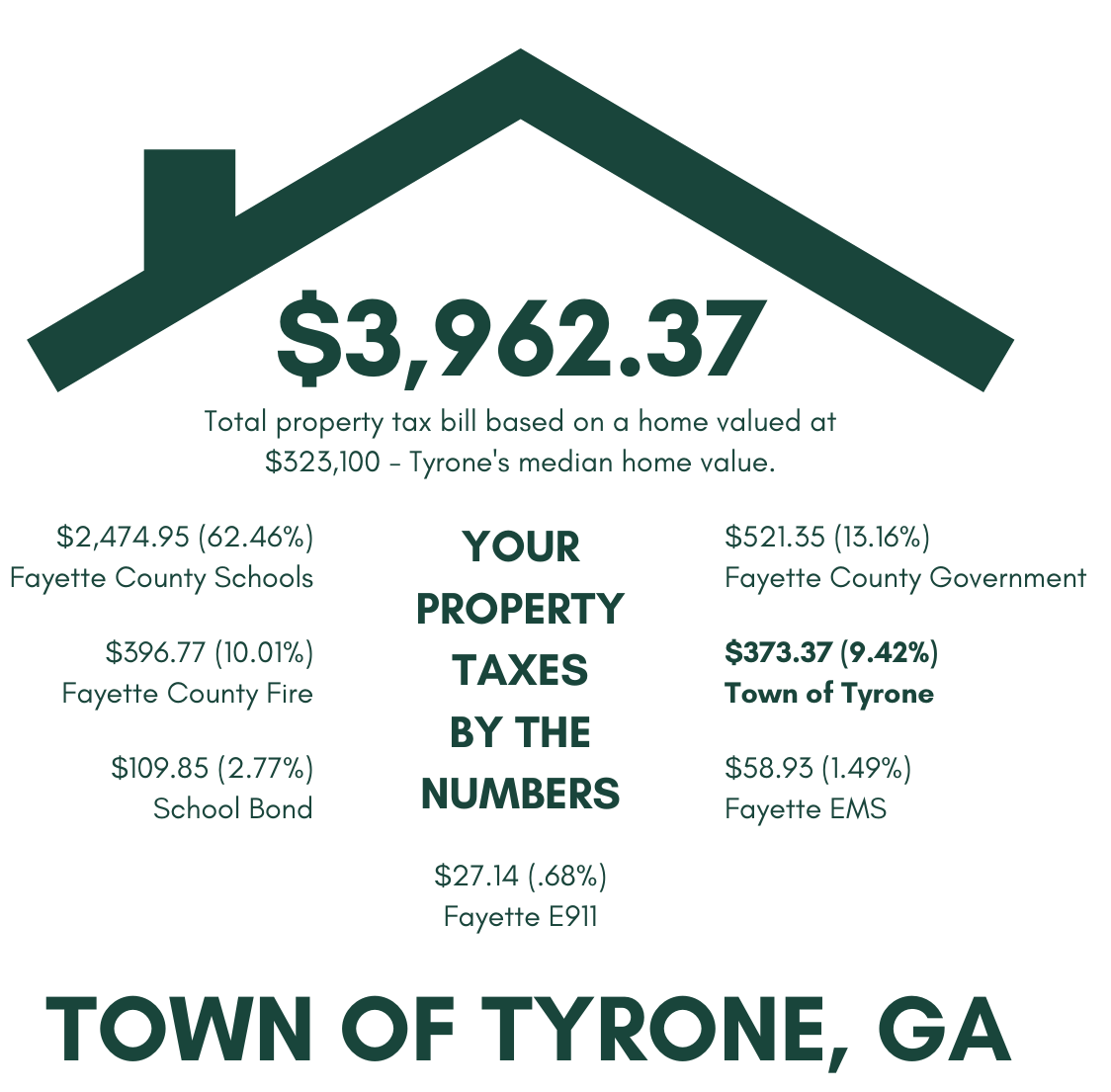

How is my tax bill distributed?

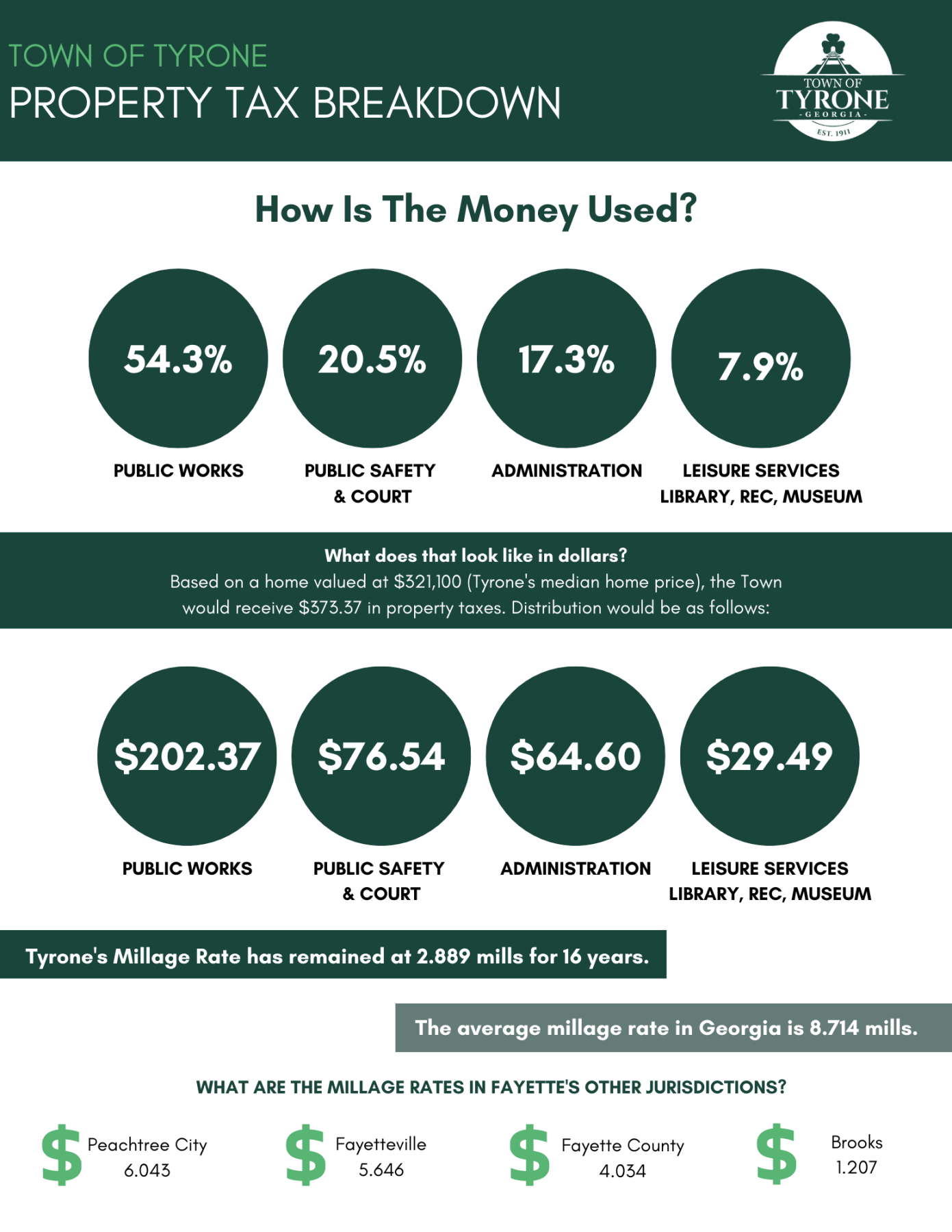

How does Tyrone use my tax dollars?

|  |

NOTICE OF REVISED PROPERTY TAX INCREASE

The Mayor and Council for the Town of Tyrone, Georgia have tentatively adopted a millage rate which will require an increase in property taxes by 1.92% percent in 2025.

All concerned citizens are invited to the public hearing on this tax increase to be held at the Tyrone Municipal Complex, 950 Senoia Road, Tyrone, Georgia 30290 on December 1, 2025 at 9:00 am.

The times and places of additional public hearings are at the Tyrone Municipal Complex, 950 Senoia Road, Tyrone, Georgia 30290 on December 1, 2025 at 6:00 pm, and December 8, 2025 at 6:30 pm. Final adoption will be held at a special called Council meeting on December 8, 2025 at 6:30 pm.

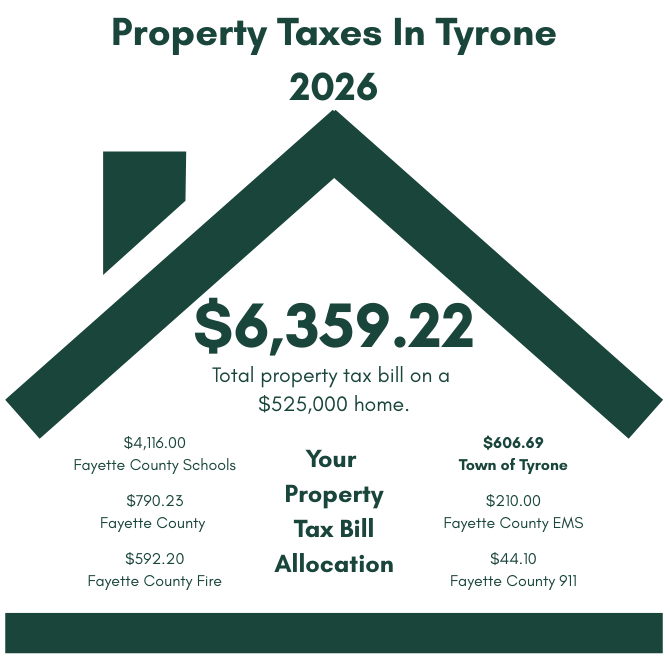

This tentative increase will result in a millage rate of 2.889 mills, an increase of .065 mills. Without this tentative tax increase, the millage rate will be no more than 2.824 mills. The proposed tax increase for a home with a fair market value of $525,000 is approximately $13.52 and the proposed tax increase for non-homestead property with a fair market value of $425,000 is approximately $11.05.

FOR IMMEDIATE RELEASE

November 13, 2025

Town of Tyrone Proposes Revised Increase in Property Taxes

The Mayor and Town Council of the Town of Tyrone, Georgia have announced today their intention to increase the collection of property taxes in 2025. This increase as compared to prior-year revenues is due to the need for a millage rate above the state-defined roll-back millage rate as calculated after the tax digest is prepared by the Fayette County Tax Assessors Office. This revision is necessary due to a recalculation of the tax digest that was beyond the Town of Tyrone's control.

During budget preparation, the Town of Tyrone committed to maintaining its Maintenance & Operations (M&O) millage at a rate of 2.889 mills. As was the case last year, the assessed value of the new construction and existing real and personal properties within the town limits have increased, and a roll-back millage was calculated at 2.824 mills.

Georgia Law requires that a government rollback their millage rate to a number of mills that will produce the same number of dollars in property tax revenue from the prior year. The Town’s millage has been at this rate for eighteen years, despite vast fluctuations in economic factors. The proposed increase in property tax revenue, year over year, amounts to $38,585 or 1.92%. The total number of dollars anticipated to be collected in property tax for 2025 is $2,050,802.

Before the Town Council can set a final millage rate at a special called council meeting on December 8, 2025 at 6:30 pm, the Department of Revenue requires that three public hearings be held to allow for the citizens to express their opinion on the potential increase. All concerned citizens are invited to the public hearings, which will be held at the Tyrone Municipal Complex, 950 Senoia Road, on the following dates and times.

Public Hearings for Town of Tyrone Property Tax Increase:

Monday, December 1, 2025 at 9:00 am Special Called Meeting

Monday, December 1, 2025 at 6:00 pm Special Called Meeting

Monday, December 8, 2025 at 6:30 pm Special Called Meeting

Final Adoption for Town of Tyrone Property Tax:

Monday, December 8, 2025 at 6:30 pm Special Called Meeting

# # #

The Town's property tax millage rate is 2.889 mils. Your bill is based on a 40% assessed valuation less a homestead exemption of your property with the following formula:

- 0.40 (assessed value) - (homestead exemption if applicable) *0.002889 = Tyrone Tax Payment